George

Is Investtg a Legit Broker? Your Top Questions Answered

|

Regulation and license |

None |

|

HQ |

Majuro, Marshall Islands |

|

Founding year |

2022 |

|

Leverage range |

Min 1:1 max 400:1 |

|

Min deposit |

- |

|

Platforms |

WebTrader for Android, Windows, and web. |

|

Tradable Instruments |

Forex, commodities, metals, indices, stocks, ETFs, |

|

Demo account |

No |

|

Base Currencies |

- |

|

Customer support |

Email (This email address is being protected from spambots. You need JavaScript enabled to view it.) |

|

Active clients |

- |

|

Publicly traded |

No |

|

Crypto |

Yes |

|

Website |

https://investtg.com/ |

Pros and Cons of Trading With Investtg

|

Pros |

Cons |

|

Leverage of up to 400:1 |

No demo account. |

|

Mobile trading app for Android users. |

No license. |

|

Allows hedging. |

No educational content or research offerings. |

|

Islamic swap-free account. |

No trading app for iOS users. |

|

Multi-asset offerings. |

New broker. |

What Is Investtg or Invest Think?

Investtg.com or Invest Think is a global forex and CFD broker. The firm launched its website in early 2022, making it one of the newest additions to the global brokers' list. Investtg.com is run by MARKETGUILD LTD, with its headquarters in Majuro, Marshall Islands. Although it's relatively new in the brokerage industry, investtg.com has not pursued licensing from local or international financial authorities.

The broker offers a decent range of asset classes for traders, including forex, commodities indices, ETFs, stocks, precious metals, and crypto. Trading at Investtg.com is done through the company's WebTrader platform. Users can access the trading platform on Android devices, Windows PC, or any major web browser. The broker doesn't provide a trading app for iOS users. Notably, a desktop-based trading platform is also unavailable.

What questions do you have about Investtg.com? Continue reading this comprehensive list of the frequently asked questions about Investtg.com to find the answers.

How long has Investgg been a forex and CFD broker?

Investgg.com or Invest Think has been a forex and CFD broker since early 2022, giving the company a short history in the industry.

Is Investtg a legit broker?

Judging by their short history in the forex and CFD trading industry, failure to offer a demo account, and lack of licensing, traders should exercise due diligence when trading with Investtg.com.

However, it normally takes up to ten years for legit brokers to establish a solid name and build a loyal following in the competitive industry. Determining whether Investtg.com is a legit broker will just be a matter of time, although no serious complaints are available about the company so far.

Are investtg spreads fixed or variable?

Investtg.com spreads are variable, but the company doesn't provide any data on the average spread rates to the public. This, combined with the restricted platform access, makes it hard to compare the spreads with the industry average rates or even to know how tight the spreads are.

Traders interested in giving Investtg.com a try might have to register and get their accounts approved to view the spread rates for different assets.

How do I find out if a forex broker is licensed?

Finding out if a forex broker is regulated and has a valid license is simple. Head over to the broker's website and check for the mention of licensing information throughout the website. If the broker provides a license and the regulating body, you can visit the official regulatory website to ensure that the license information is valid.

Don't sweat if you find more information about licensing and regulation on the official broker's website. The broker is unlicensed. Brokers with valid licenses are always proud to mention and display it on their websites as it adds to the customers' trust score.

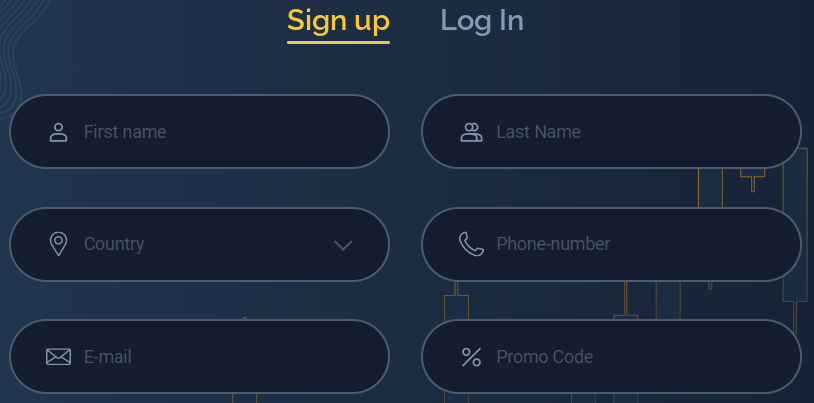

How do I sign up for an Investtg trading account?

Anyone who wishes to register for an Invest Think trading account can follow these steps.

- Visit the official broker's website.

- Click the 'Create Account button at the top right section of the broker's website.

- Fill out all the required fields.

- First name

- Last name

- Country

- Phone number

- Promo code (if applicable)

- Click the 'Create Account button to submit your details.

- Check and click the verification link sent to your email.

- Sign in to access and verify the account.

- Contact customer support if you want an Islamic account.

What types of accounts does Invest Think offer?

Investgg.com offers two types of accounts:

- Real account

- Islamic account.

The only difference between the two accounts is that the Islamic account is swap-free. Users with the Islamic account do not incur interest for overnight positions, which is in compliance with Sharia law.

Does Investtg offer a demo account?

Investtg.com does not offer a demo account for traders to try out the platform and practice their trading strategies. The lack of a demo account can make it difficult for traders to assess whether the broker's platform is superior and has the features a trader needs to trade successfully.

Is Investtg licensed?

Investtg.com or Invest Think does not hold any license, meaning the broker is not regulated by any financial authorities in any part of the world.

Should I trade with Investtg?

Trading with any forex and CFD broker should always be a personal decision. Always weigh the pros and cons of trading with the broker before deciding to sign up and risk your hard-earned money. Here's a list of the pros and cons of Investtg.com to help you make an informed decision.

Pros of trading with Invest Think

- Two customer support options with prompt responses

- Segregates clients'' funds

- Offers a leverage of up to 400:1

- An impressive range of asset offerings

- Islamic swap-free account

- A mobile trading app for Android

- Hedging is allowed and supported

- Same-day withdrawal request processing

Cons of trading with Invest Think

- Unlicensed and unregulated broker

- Lacks a demo account

- Doesn't provide educational and research materials

- A short history in the FX and CFD industry

- No trading app for iOS and Mac users

- Fails to provide the average fees data

- Limited payment methods

- No customer service during weekends

Does Investtg offer Nas100?

Yes, Investtg.com offers Nas100.

How many currency pairs are available on Investtg?

Due to the lack of a demo account and restricted access to the broker's platform, it's not clear the number of currency pairs available on Investtg.com.

Does Investtg.com accept PayPal deposits?

No. Investtg.com doesn't accept PayPal deposits or withdrawals. Instead, Investtg.com accepts the following deposit and withdrawal methods.

- Credit and debit cards

- Bank wire transfer

How can I contact Investtg?

You can contact Investtg.com customer support via email or live chat 24/5. The contact email is This email address is being protected from spambots. You need JavaScript enabled to view it.. The live chat feature is available on the company's website.

What is the minimum lot size for Investtg?

Investgg minimum volume of a transaction is 0.01 lot. The company can change the figure from time to time, but this data is usually available for viewing before placing an order on the trading terminal.

Can investtg close my trades if I don't have sufficient margins?

Yes. You must have sufficient margins to open or close a position on Investtg. If the margin is not maintained, Investtg can close your open trades.

What's the minimum withdrawal limit on Investtg?

Investtg.com allows a minimum withdrawal limit of $50. Traders can withdraw funds via bank transfer, credit card, or debit card.

However, traders can only withdraw to a card or account bearing their name.

Is my money safe with Investtg?

Investtg.com stores clients' funds in a separate bank account from the company funds. Segregating customer funds prevent the use of client funds for company purposes and also guarantees traders that they can get their money back if the broker becomes insolvent.

What is the financial condition of Investtg?

Investtg.com doesn't provide information about the company's financial condition. It's usually important to know if a company is doing well financially to avoid signing up with a company that's about to go under. The most straightforward way to know more about a company's financial condition is through its balance sheets.

Does Investtg offer bonuses?

Yes. Investtg.com offers promotional bonuses at its discretion. However, there are requirements for withdrawing the bonuses or the profits made by trading with the bonuses.

A trader must execute trades with a minimum volume equivalent to the bonus amount divided by four. If a trader receives $1000 in bonuses, they must fulfil a trading volume of at least 1000/4 ($250) within 60 days. If the trader doesn't fulfill the requirements within 60 days, the broker can withdraw the bonuses, even if it means stopping your ongoing trades to recover the amount.

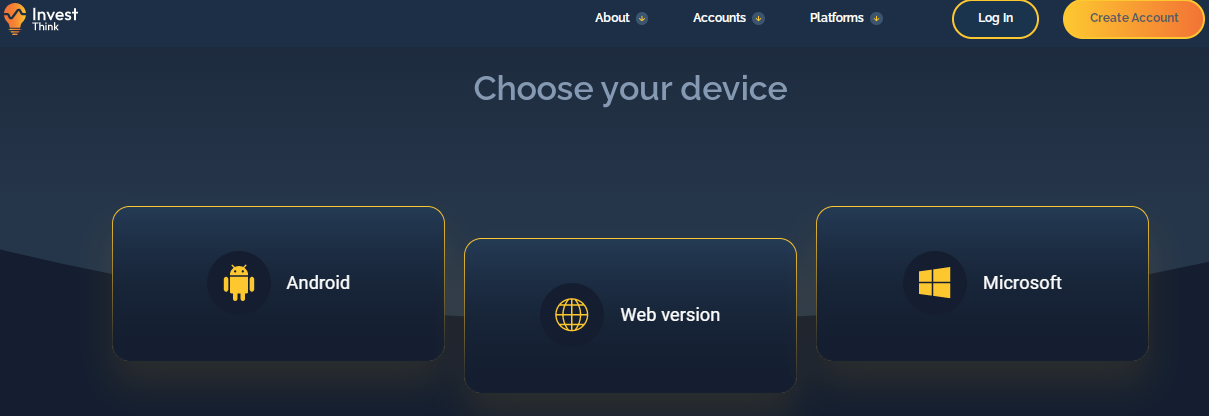

What trading platform does Investtg offer?

Investtg.com provides its traders with the WebTrader platform. The broker provides different versions of the trading platform.

- Android app

- Desktop-based trading platform (Windows)

- WebTrader (web-version)

Does Investtg offer MT4 or MT5?

No. Investtg.com doesn't provide MT4 or MT5 trading platforms. The broker utilizes the WebTrader platform.

What is the Investgg company address?

Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Marshall Islands MH96960.

Does investtg allow hedging?

Yes. Investing.com allows hedging on its platform. Hedging allows a trader to simultaneously hold a buy and sell position for the same currency pair.

Who owns Investtg?

Investtg.com is owned and run by MARKETGUILD LTD, with its headquarters in Majuro, Marshall Islands.

Are there any trading restrictions on Investtg?

Investtg.com does not provide major trading restrictions on its website. However, traders can only access leverage of up to 400:1. Not every trader is guaranteed that rate. Investtg decides the amount of leverage to allocate at its discretion. This means the company can also adjust a trader's allowed leverage. When trading with bonuses, the maximum possible leverage is 100:1.

What is the quality and availability of customer service on Investtg?

Investtg.com provides short waiting times for customer support questions via live chat on the broker's website. Support is available twenty-four hours a day for five days. Requests sent during weekend hours might wait until the following week.

What information do I need when opening an Investgg account?

Investtg requirements for signing up are really simple. Below is the information you will need to open an Investtg.com account.

- First name

- Last name

- Country

- Phone number

- Promo code (if applicable)

Does Investtg require verification documents?

Yes. Investtg requires customers to verify their accounts by submitting verification documents. The documents required are

- Proof of address document (for instance, utility bill or bank statement)

- Proof of residency documents (driver's license, government-issued ID, passport etc.)

These documents shouldn't be older than three months. According to the broker's terms and conditions, a trader must have a verified account to withdraw funds.

How long will it take for my deposit to reflect in my account balance?

Investgg.com doesn't mention the average time it takes for deposits to reflect in a trader's account balance. However, in most cases, it depends on the chosen payment methods.

Can I deposit or withdraw funds into another person’s account?

No. In compliance with the anti-money laundering rules, Investtg.com does not allow deposits or withdrawals from accounts that do not bear your name.

What is the swap-free Islamic account option on Investtg?

An Islamic account is also known as a swap-free account. It's a common type of account in the forex industry that's meant for followers of the Muslim faith. It helps them trade while adhering to Sharia law. With an Islamic account, traders are not charged interest for overnight positions.

Does Investtg charge an inactive account fee?

We didn't find the mention of inactive fees on Investtg.com. Broker's usually charge inactivity fees for accounts that remain dormant for a certain period. Dormant means there are no trading activities, withdrawals, deposits, etc., which

does not provide any information about account inactivity fees, such as how long it takes for an account to be dormant and how much a trader is charged in that situation.

Can I open multiple Investtg trading accounts?

Investtg.com provides two account options only. The real account and an Islamic account. When you sign up with the broker, the default account is the real account. To change to an Islamic account, you can contact the broker's customer support with your details, and they'll update your account. Contact the Investtg.com support team by emailing This email address is being protected from spambots. You need JavaScript enabled to view it. or live chat on the company’s website.

Does Investgg keep my funds in segregated accounts?

Yes, Investtg.com segregates clients' funds from company funds. It's important to keep funds in that manner to avoid misappropriation of customers' funds. Also, in case the company becomes insolvent, clients can possibly get a refund of their deposited money.

How can I access the Investtg trading platform?

To access the Investtg trading platform, you must have an approved account. You can choose how you want to access the platform (web, mobile app, desktop) and proceed accordingly. You can download mobile apps and desktop-based software on the broker's website. Bear in mind that the mobile app is only available to android users, and the desktop trading platform is meant for Windows users. If you want to access the Investtg platform via web browser, you can simply log in to your account from the official website.

How many traders does Investtg have?

Investtg doesn't disclose the number of active traders on its platform. Obviously, the broker doesn't have a large number of customers since the broker started its operations in 2022.

What country is Investtg held?

MARKETGUILD LTD owns Investtg. This company is headquartered in Majuro, Marshall Islands.

The precise address provided on the broker's website is Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Marshall Islands MH96960.

Is Investtg accredited to work with retail traders in my country?

Regardless of your country of residence, the short answer is no. Investtg.com does not hold a license in any country.

What are other traders saying about Investtg?

Investtg.com doesn't have many individual customer reviews yet, but it's only a matter of time. Most traders are wary of new brokers due to the existence of unscrupulous brokers. However, even with individual customer reviews, take the reviews with a grain of salt. Not every review out there is honest and well-intentioned.

Is Investtg good for beginner traders?

Investtg.com is open to all types of traders, experts and novices. However, the broker doesn't provide a demo account, so the trader must have some experience trading, particularly with the WebTrader platform. Also, there are no educational and research sections on the website. Traders must have some other source of industry knowledge.

Is Investtg regulated in South Africa?

Investtg.com is not licensed in South Africa or any other country. In South Africa, brokers are licensed and regulated by the Financial Sector Conduct Authority (FSCA).

What is Investtg all about?

Investtg.com is all about offering forex and CFD trading. The broker provides its clients worldwide access to various financial instruments. For trading, Investtg utilizes the WebTrader platform.

Does Investtg accept PayPal?

No, Investtg.com doesn't accept PayPal either for depositing or withdrawing funds. Traders can only use credit/debit cards and bank transfers.

How long does it take for withdrawal requests to be processed on Investtg?

Investtg.com promises same-day withdrawal processing. If you submit a withdrawal request, the broker will process your request on the same day, excluding weekends. However, your payment services provider (a bank) will determine the transaction processing timelines.

Does Investtg offer trading guidance and strategies?

No. Investtg.com doesn't offer any trading advisory services and trading strategies. The broker also doesn't have any educational content on its website.

Does Investtg offer trading signals?

No. Investtg doesn't provide trading signals for its clients. It's a broker that provides its clients with a platform for accessing various financial instruments and executing trades.

How good is the Investtg trading platform?

Investtg.com provides its clients with the WebTrader platform. Invest Think offers an Android mobile app, a desktop-based Windows platform, and a web-based platform. For two reasons, you cannot test the broker's platform to identify how good it is. Investtg doesn't have a demo account that allows you to trade using virtual currency. Second, you cannot access the trading platform until your account is approved. Even then, you'll be testing the platform using your own money.

How can I see the status of my pending orders?

You can see the status of your orders on Investtg.com, your online trading platform. You must access the online trading platform or contact the company if that's impossible.

Where does Investtg get its pricing information?

Investtg determines all the prices traders see on the broker's trading terminal at its own discretion.

How can I tell if a broker is a scam?

Scam or unscrupulous brokers do a good job of concealing their intentions, and that's why traders still fall for them. However, most scam brokers have some or all of these characteristics:

- Little or no company details on the website, including lack of a headquarters address.

- Too good to be true reviews. (Even the best companies have negative reviews)

- Hard to understand terms and conditions.

- Hidden fees.

- Lacks a license.

- Limited customer support methods.

- Frequent calls to push you towards making deposits faster.

- Promising returns. (Even past results don't guarantee future returns in trading)

- Offers huge bonuses.

- Offshore headquarters.

It doesn't mean that every broker with one or two of the above characteristics is a scam. You should consider all the details about the company like those discussed in these Investtg.com FAQs.

Pros and Cons of Investing With Definite Area

|

Regulation and License |

None |

|

HQ |

Not disclosed |

|

the Founding year |

2022 |

|

Leverage range |

- |

|

Minimum deposit |

$250 |

|

Platforms |

Definite Area’s web-based platform |

|

Tradable Instruments |

Pair currencies, indices, commodities, cannabis, ETFs, crypto |

|

Demo account |

No |

|

Base Currencies |

EUR GBP USD AUD NZD CHF CAD |

|

Customer support |

Yes (English) |

|

Active clients |

Unknown |

|

Publicly traded |

No |

|

Crypto |

Yes |

|

Website |

https://definitearea.com/ |

What Is Definite Area?

Founded in March 2022, Definite Area is a newcomer to the highly competitive online brokerage landscape. The broker gives its clients access to various markets, for instance, commodities, indices, shares, forex, cannabis, and cryptocurrencies. The company is unregulated and does not provide its headquarters address. While the broker offers services to clients worldwide, Definite Area does not accept U.S. traders like many forex brokers.

Trading at Definite Area is done through the broker's web-based platform. The trading platform is accessible via different web browsers like Chrome, Firefox, Safari, and Internet Explorer. The broker does not offer a downloadable platform or a functional mobile application for trading.

Every broker comes with its own pros and cons. While that is a guarantee, some brokers are better off than others depending on what a trader's needs are. This in-depth guide will look at the advantages and disadvantages of investing with Definite Area to help traders determine if the broker is the right fit for them and avoid unwelcome surprises.

Overview of the Pros and Cons of Investing With Definite Area

While some brokers are generally praised by most of their traders, not every company can satisfy all types of traders. Every forex and CFD broker has its own pros and cons. But there are key areas/things which every broker should have to help traders trade safely and profitably. Based on the key things a broker should have here is an overview of the pros and cons of investing with Definite Area.

Pros

- Easy and quick payment methods

- Varied customer support options

- A variety of order entry types

- Segregates customers funds

- Extensive product offerings

Cons

- Unlicensed and unregulated

- Undisclosed withdraw fees

- Only a web-based trading platform

- No demo account

- Limited free trading educational content and tools

- Failure to disclose basic company information

Definite Area Pros Explained

Easy and Quick Payment Methods

One of the most important aspects traders consider when selecting a broker is the deposit and withdrawal procedures and methods. While some brokers make traders wait for a longer time to trade after making deposits with wire transfers, Definite Area offers swift deposits. The other payment methods traders can use to deposit and withdraw funds are credit/debit cards and cryptocurrencies.

Varied Customer Support Options

Industry standards for customer support are easy to access via live chat, email, and phone. Definite Area offers three options.

- Live chat: Can be launched when logged in to the platform.

- Phone: +442035355844, +3197010282402

- Email This email address is being protected from spambots. You need JavaScript enabled to view it.

When it comes to the timeline in which you can reach the broker, most brokers offer 24/5 support.

A Variety of Order Entry Types

Definite area of a variety of or the types which are important for protecting atria against excessive slippage. The broker's platform has all the minimum requirements for order types:

- Stop limit order

- Stop order

- Guaranteed stop-loss

- Market order

- Limits order

Segregates Customers' Funds

The safety of a trader's funds is a very important consideration when looking for a forex and CFD broker. There are many things that go wrong even with an established broker, for instance:

- Bankruptcy

- Internet exploits (hacks)

- Suddenly shutting down

Sometimes even with regulated brokers, there is no guarantee of account protection as with the stock market. However, when a company keeps the client's funds separate from company funds, (like Definite Area does) there is an added layer of protection.

Extensive Product 0fferings

Definitive area provides its clients with access to various markets. At the time of writing this guide traders can access the following:

|

Market |

Quantity (approximately) |

Examples |

|

Forex (currency pairs) |

52 |

EUR/USD, GBPUSD, USDCAD, CHFJPY, AUDUSD |

|

ETFs |

12 |

GLD, SPY, QQQ |

|

Cannabis |

9 |

ABBV, MO, SMG, TER |

|

Crypto |

90+ |

BTCUSD, WAVEUSD, LTCUSD, XRPUSD |

|

Indices |

19 |

NASDAQ, SP500, Dow, FTSE100 |

|

Individual stocks |

30+ |

Tesla, Amazon, Uber, Twitter, Facebook, Nextflix |

|

Commodities |

17 |

Wheat, rice, coffee, sugar, corn |

Definite Area Cons Explained

Unlicensed and Unregulated Broker

Most trustworthy and established forex and CFD brokers are regulated. And that is why traders are wary of unlicensed, unregulated brokers. Every country has a financial regulatory authority that licenses firms to operate in their jurisdiction. When it comes to the United States, brokers can only offer their services to U.S. residents if they are registered with the national futures association (NFA).

Regulation and licensing mean the broker must comply with the rules and regulations stipulated by the regulating authority. If the broker violates the rules then traders are assured that the broker will face legal disciplinary actions. With unlicensed brokers like Definite Area traders are not guaranteed the broker will face legal action in case it violates trading rules.

Undisclosed Withdrawal Fees

Most forex brokers usually give traders a stressful time when it comes to withdrawals and closing an account. From the broker's terms and conditions, traders are charged a commission on withdrawals but the exact amount is not disclosed.

The broker also doesn't provide clear procedures to follow if a trader wants to opt-out or close the trading account. It's usually a good idea for traders to understand the account closure procedures in case they want to terminate the partnership in the future.

Only a Web-Based Trading Platform

A broker's trading software matters a lot because it's where traders execute their trades. That is why there should be a mix of desktop-based, web-based, and mobile-based platforms. Web-based platforms are usually great but may lack some features which are crucial in executing different trading strategies.

No Demo Account

Most brokers provide a demo account to allow new traders to practice their trading strategies and acquaint themselves with the interface, without risking real money. A demo account also enables even experienced or seasoned traders to examine the broker's platform before commencing trading. That is because the demo account is a clear reflection of what it is like to trade with a broker. It has the same features like watchlists, quotes, charts, and bid and ask prices, as the broker's live account.

Traders should be wary whenever a broker does not provide a demo account. After all, how can traders tell if the broker is using a superior or outdated platform? How it is like to trade with the broker?

Limited Free Trading Educational Content and Tools

Brokers should provide numerous educational materials to help their customers make informed decisions and enhance their trading skills. The educational section of Definite Area has very limited content:

- A glossary of common trading terms

- Explanation of technical analysis

Most established brokers provide various educational resources, like webinars, video tutorials, and in-depth blog posts on various trading topics. The educational section should also contain tutorials on a broker's trading platform.

For Definite Area, clients can only access educational content when they are signed in to their accounts except when using the standard account.

Failure To Disclose Basic Company Information

Definite area does not disclose basic company information like

- Company's history

- Headquarters address

- Registered company name

- Company's finances

This means that traders are dealing with an anonymous broker. Most brokers do provide such information for anyone to access through their websites and help to build trust with the brand.

Our Final Thoughts on Investing With Definite Area

Every broker has its pros and cons. Traders weigh each and decide if the broker is worth their time and money. Some of the pros of Definite Area are its multi-asset offerings, various order types, different options for contacting customer support, segregation of clients' funds, and clear payment methods/procedures.

The cons of trading with Definite Area include lack of a demo account, undisclosed withdrawal commissions, limited educational and research content, no company information, lack of licensing, and a web-based only trading platform.

FAQ

What is Definite Area?

Definite Area is a forex trading company that provides traders with access to major financial markets.

Is Definite Area regulated?

No, Definite Area is an unlicensed and unregulated brokerage firm. The broker does not offer services to U.S. traders because brokers must be registered with the National Futures Association (NFA) to offer FX trading services to US residents.

While the regulation does not mean the broker will never violate trading rules, it assures traders that the broker, in such an event, will face legal consequences. That is not the case with unregulated brokers.

What are the Definite Area trading fees?

Trading financial markets come with trading and non-trading fees. The trading fees include

- Swap fees

- Spreads

Definite area offers competitive spread rates of about 0.1 euro (pips) for popular currency pairs like EUR/USD. The swap rates are fixed but the amount is not stated on the broker's website and terms and conditions document.

The non-trading fees include:

- Deposit and withdrawal commissions

- Account inactivity fee

Definite Area charges a commission on withdrawals and also a fee on inactive accounts. However, the precise fees are not disclosed.

What are the Definite Area non-trading fees?

Definite Area non-trading fees are charges that are not directly related to trading activities. These include fees charged on deposits, withdrawals, and inactive accounts.

Where is the headquarters for Definite Area?

Definite Area doesn't disclose where the company's headquarters is based. It also doesn't provide other basic company details like company history and registered company name.

How long has Definite Area been in business?

Definite Area is relatively new in the online brokerage space. The company was founded around March 2022 which means it's been in business for a few months only.

Does Definite Area accept PayPal?

No, Definite Area doesn't accept PayPal deposits and withdrawals. The accepted payment methods are

- Credit/debit cards

- Crypto transfers

- Bank wire transfers

Does Definite Area have NASDAQ?

Yes, Definite Area offers NASDAQ and about 15 other indices like SP500.

Does Definite Area offer a demo account?

No, Definite Area doesn't provide prospective clients with a demo account. This is usually not a good thing because traders (both novice and seasoned) should first try out a platform before investing real money.

How to start trading with Definite Area?

Prospective clients from eligible countries who are above 18 years can start trading with Definite Area in a few steps. It all starts with creating an account and making an initial minimum deposit of 200 Euros. To create an account:

- Go to the broker's website

- Click the 'Open account' button

- Enter the required details in the pop-up form (first name, last name, email address, country, phone number, and password)

- Hit 'Submit'

- Use the email address and password generated in the previous step to log in

How can I contact Definite Area customer support?

You can contact Definite Area's customer support team by emailing This email address is being protected from spambots. You need JavaScript enabled to view it. or calling +442035355844, +3197010282402. Anyone who has an account can also access support by launching the live chat feature embedded on the platform.

What payment methods does Definite Area accept?

Definite Area accepts crypto transfers, bank wire transfers, and credit/debit cards.

How long do Definite Area withdrawals take?

While clients can withdraw funds any day, the withdrawal processing timelines are between one and seven business days. If there are further delays, the broker updates the client through email or phone.

What is the timeline for Definite Area deposits?

Definite Area deposit timelines are usually dependent on the trader's financial services provider processing time. Which, for the broker's accepted payment methods is a matter of minutes if not seconds.

What is the initial minimum deposit for Definite Area?

To start trading with Definite Area, prospective clients must make an initial deposit of 200 euros. The amount is within the industry's average as most brokers accept anywhere from $10 to $500.

How will my withdrawal be processed by Definite Area?

Clients choose the payment method to which they wish to receive funds, for example, crypto transfer, bank transfer, or debit card transfer. The broker doesn't state the minimum amount required to withdraw. However, the account to which the client intends to withdraw must bear the same name as what is available with the broker.

Does Definite Area offer the MetaTrader platform?

No, Definite Area does not offer the MetaTrader platform. The MetaTrader is regarded as a standalone and industry-standard trading software with numerous features, for instance, a personalized watchlist, market news, price charts, and research.

Instead, Definite Area built its web-based trading platform.

Can you access the Definite Area trading platform on a mobile app?

Mobile apps for trading are convenient whenever traders are on the go. Unfortunately, Definite Area clients don't have a mobile app for executing trades on the go.

Does Definite Area offer bonuses?

Yes, Definite Area offers bonuses to all account holders except those with a standard account. Bonuses come with a set of rules, for instance, a trader cannot withdraw the bonus amount until they meet certain criteria. The criteria are usually executing a number of trades.

What type of accounts does Definite Area offer?

Definite Area offers seven types of accounts: standard, bronze, silver, gold, platinum, pro, and VIP. The accounts give traders access or limit access to various features like leverage cap, number of insured trades, financial plans, personal financial assistants, market news and an economic calendar, company financing, and educational courses.

Are my funds safe with Definite Area?

Definite Area keeps the client's funds in a separate account from its corporate funds. Segregating customers' funds usually protects traders if a company faces a difficult financial situation. However, when trading margin products, no broker can guarantee 100% safety of funds.

Will Definite Area accept my account application?

Definite Area accepts most account applications instantly. However, the company has the right to reject any account registration at its own discretion.

Can Definite Area terminate my account?

Yes, Definite Area can terminate a trader's account temporarily or permanently. The cited reason in the broker's terms and conditions is lack of account verification which usually requires new customers to upload:

- Proof of identity documents (photo ID, passport, or driver's license)

- Proof of address (utility bill, bank statement, etc.)

Are there any risks involved with trading with an unlicensed broker like Definite Area?

Yes, there are risks involved when trading with unlicensed brokers. First, licensing can help to verify if the company is legit and not a scam. Most scam brokers usually don't have licenses and when they indicate they have one on their website, it's usually a fake one. The process companies go through to acquire a license weeds out weak companies.

Also, there is no guarantee that an unregulated broker will face legal scrutiny if it violates trading rules.

What are the registration requirements for Definite Area?

Definite Area doesn't have many requirements for prospective clients to register. The only requirement is that the trader is at least 18 years and accepts the firm's terms and conditions.

Another thing that can affect a trader's ability to register for an account with Definite Area is the country of residence. At the moment, Definite Area doesn't accept traders from the United States.

What trading instruments does Definite Area offer?

Definite Area offers its clients a variety of financial instruments across major financial markets. Here's what traders can access with the broker:

- About 52 currency pairs, including the popularly traded EURUSD.

- 12 ETFs which include GLD and SPY.

- Nine cannabis

- Popular crypto and USD pairs like BTCUSD

- 19 Indices including NASDAQ and SP500.

- Individual stocks like TSLA and AMZN

- 17 commodities, including wheat and coffee.

How are the Definite Area lot sizes for currency pairs compared to the industry’s average?

A lot size is the smallest available trade size a trader can take for a particular currency pair. The lot size standard can vary depending on the currency. For the US dollar, the average lot size is 100,000 dollars. Definite Area offers micro lots starting with 1000 units so it is at par with the industry average.

Does Definite Area offer zero negative balance protection?

Definite Area doesn't mention whether it offers zero negative balance for its clients. Typically a zero negative balance guarantees clients that they won't pay more than the money available in their trading accounts if a trade goes against the trader leading to a crash. Given the volatility of FX and CFD trading, a zero negative protection balance can help traders recover from crashed positions that drain their accounts.

Are there any fees charged for closing a trading account with Definite Area?

Definite Area's website and terms and conditions document doesn't indicate whether a trader incurs any fees for closing an account. Also, there are no guidelines for the process or procedure of closing an account.

Does Definite Area offer trading education and tools?

Yes, Definite Area offers ver limited educational content on its website but claims to offer educational courses for traders with all account types except the standard account.

Albicchiere is a dispenser that keeps wine fresh for up to 6 months

It also selects the ideal supply temperature for it and protects it from children.

At crowdfunding, there is an interesting new project - an automatic dispenser for Albicchiere wine, which not only serves the drink at the ideal temperature but also extends its shelf life up to 8 times compared to similar devices of other manufacturers.

As noted by the manufacturers, this device solves the problem when you want a glass of wine, but you do not want the rest to spoil. If you pour wine in Albicchiere, the shelf life of the drink is increased to 6 months from the moment the bottle is opened. In comparison, if you close it with a regular cork, it will expire in less than a month.

Enter the grade data of the drink and the device will select the best temperature for the drink. For details and recommendations, please see the company appendix. The creators have also provided a parental control function: the device can be locked remotely to ensure the safety of children (and wine).

Before filling the gadget, wine must be poured from the bottle into a special dense bag: it blocks the airflow after you close it and does not affect the taste of the drink. The packs are reusable: you can simply wash them before using them again.

English (UK)

English (UK)  Arabic

Arabic